The Power of Audit Review Compilation for Financial Services, Accountants, and Tax Services

In the realm of Financial Services, Accountants, and Tax Services, audit review compilation plays a pivotal role in ensuring the integrity and accuracy of financial records. It serves as a vital tool for businesses seeking to maintain compliance with regulations, enhance transparency, and drive strategic decision-making.

Understanding Audit Review Compilation

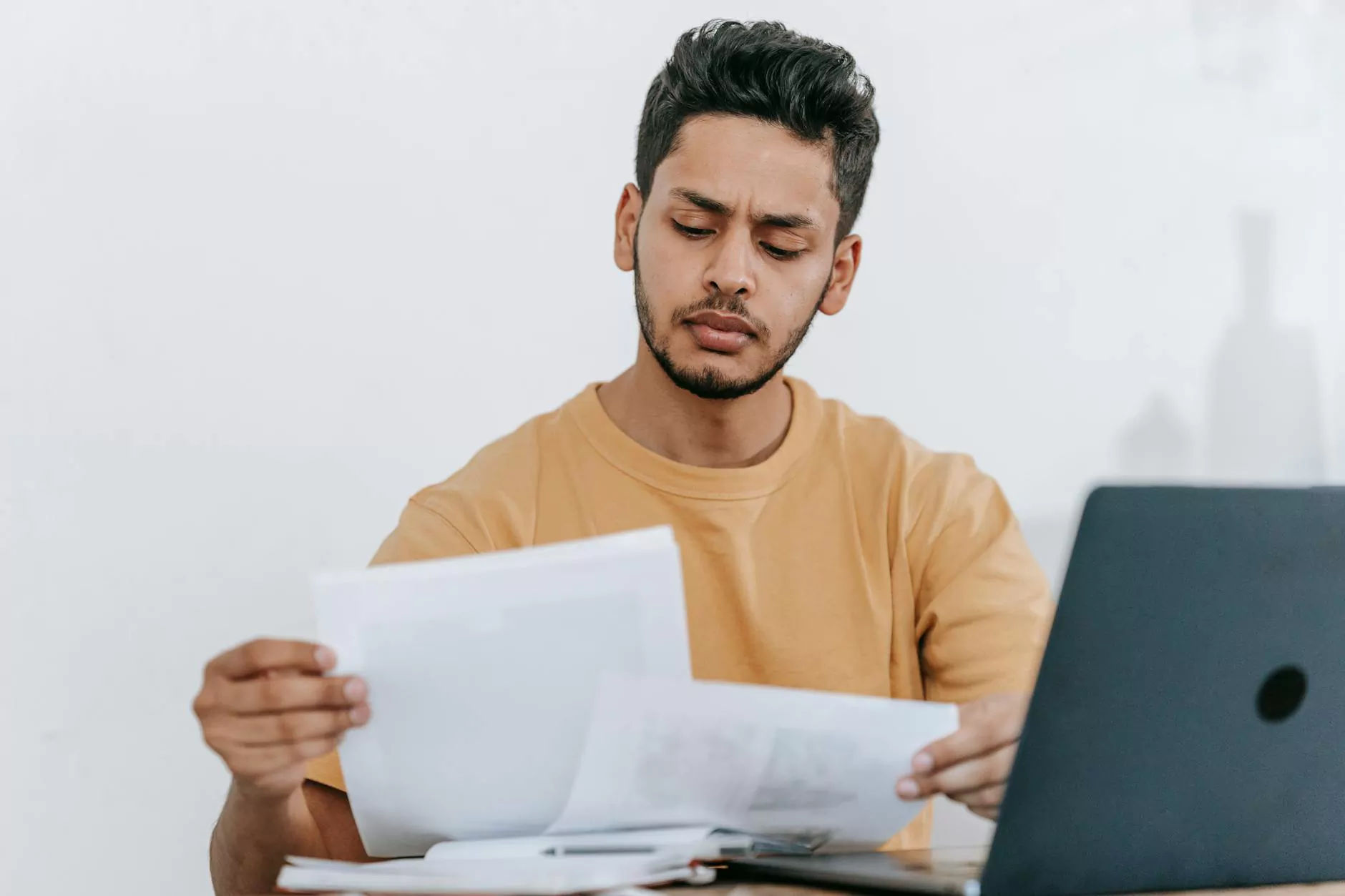

Audit review compilation involves the meticulous examination of financial statements, records, and processes to assess their accuracy, completeness, and reliability. Through this comprehensive evaluation, businesses can identify potential discrepancies, errors, or fraudulent activities, thus safeguarding their financial integrity.

Benefits of Audit Review Compilation

1. Enhanced Compliance: A thorough audit review compilation ensures that businesses adhere to regulatory requirements and financial standards, reducing the risk of penalties or legal issues.

2. Improved Transparency: By conducting regular audit review compilations, businesses can enhance transparency and accountability, fostering trust among stakeholders and investors.

3. Strategic Decision-Making: The insights gained from an audit review compilation can provide valuable data for informed decision-making, leading to improved operational efficiency and profitability.

Why Choose TaxAccountantIDM.com for Audit Review Compilation?

At TaxAccountantIDM.com, we specialize in offering top-notch audit review compilation services tailored to the unique needs of Financial Services, Accountants, and Tax Services clients. Our team of experienced professionals combines industry expertise with cutting-edge technology to deliver accurate and timely results.

Conclusion

Audit review compilation is a vital function for businesses operating in the Financial Services, Accountants, and Tax Services sector. By partnering with a trusted provider like TaxAccountantIDM.com, businesses can unlock the benefits of enhanced compliance, transparency, and strategic decision-making.